Finances and Cost of Living in NZ

TAXATION

The Inland Revenue Department (IRD) manages taxation issues for individuals, families, businesses, employers, non-residents and visitors from New Zealand.

If you get a job in New Zealand the first thing you need is to apply for an IRD number, otherwise tax will be deducted at the «no notification» rate (currently 45 centimes for every dollar earned)

TAX RATES

New Zealand tax year runs from 1 April to 31 March. For every $1 earned, you will pay:

- 10.5 cents of every dollar for income up to $14,000

- 17.5 cents of every dollar for income from $14,001 and $48,000

- 30 cents of every dollar for income from $48,001 to $70,000

- 33 cents of every dollar for income of $70,001 and over

To work out the tax on that taxable income you can use this Annual Income Calculator.

New Zealand has a tax on consumption called Goods and Services Tax (GST). It applies at a flat rate, currently 15%, on almost all purchases.

Tax for Company income: 28%

COST OF LIVING

Mercer’s 2012 Cost of Living Survey ranks Auckland (56) and Wellington (74) far better than many other major cities like Sydney (11), London (25) and New York (33) – showing that major New Zealand cities are more affordable than other English-speaking countries.

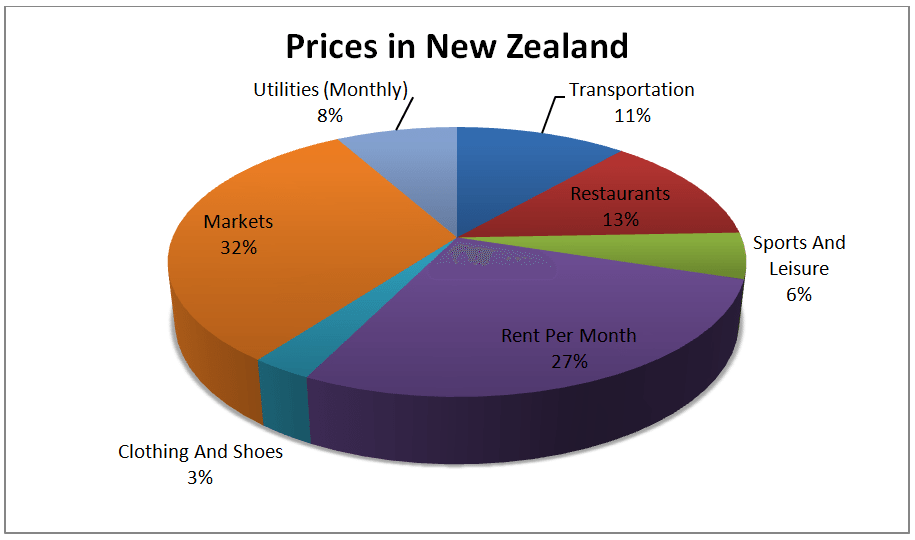

According to a statistic generated by Numbeo in April 2014, the price of products on the market in relation to other prices is almost 32% which represents a significant expense, followed by eating out at restaurants (13%) and transportation (13%).

Buying clothes, practicing sports or going the cinema do not represent a very high price if compared to other countries

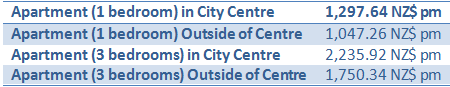

Accommodation may vary depending on the number of rooms and location:

EXCHANGE RATE

Rates are roughly 0.5 GBP to 1 NZD. See today’s rates on the Money Converter website.

——————————————————————————————

Start your journey here

Browse hundreds of articles and guides to discover more!