How to choose the right medical indemnity provider for you

A guide to the main UK medical defence organisations, with an aim of helping you choose the right medical indemnity provider for you.

Medical protection organisations exist to provide legal and practical advice and support to clinicians. Until 2019, having individual indemnity was optional, but it is now a GMC requirement for all practising clinicians to have personal cover appropriate to their role. Here we explore the changes in national guidance, and provide a guide to the main medical defence organisations (MDO) in the UK. We hope this helps you choose the right medical indemnity provider for you.

What is medical indemnity/medical protection?

Medical indemnity is a specific area of insurance that relates primarily to medical errors, negligence or mistakes occurring while undertaking clinical work. It provides legal support to doctors in the event of problems with regulatory bodies, such as the GMC.

Any doctor working in the UK will be aware of the increasing amount of litigation and lawsuits. This has started to lead to a culture of defensive medicine and is a reason for ensuring medical indemnity is in place. It can offer security and reassurance when engaged in work as highly pressured and increasingly accountable as clinical practice.

Medical indemnity can also provide insurance cover for other roles outside the workplace, which would not be covered by employers or work-place insurance. This includes work in clinical education, clinical research, and out-of-workplace incidents such Samaritan acts and passer-by assistance.

Medical indemnity providers, also call Medical Defence Organisations (MDO) can also offer a wide range of other services, including health advice, education and CPD, mortgage and financial services, debt advice and discounts to other organisations. These are aimed at supporting doctors and to help them enjoy work-life balance and good quality of life.

Is medical indemnity necessary?

NHS bodies and organisations are financially responsible for the clinical negligence of their employees. All NHS Trusts/ Health Boards in England, Scotland and Wales are members of the state-backed NHS medical schemes:

- England – indemnity is provided through the Clinical Negligence Scheme for Trusts (CNST), which is administered by the NHS Resolution.

- Wales – indemnity is provided through the Clinical Negligence Scheme for Trusts and Health Board by Welsh Risk Pool Services.

- Scotland – indemnity is provided by the Clinical Negligence and Other Risks Indemnity Scheme (CNORIS). NHS National Services Scotland is the Scheme Manager, with the Central Legal Office providing legal advice and guidance to Health Boards.

- Northern Ireland – each health and social care trust provides its own indemnity, funded by the Department of Health, Social Security and Public Safety.

GMC

In 2019, the General Medical Council updated its guidance on insurance and indemnity for doctors. This applies to all doctors working in the UK, whether in training or fully qualified, in primary/secondary or tertiary care, or employed in private or public NHS practice. This followed the launch of new state-backed clinical negligence schemes in April 2019 for General Practitioners across England and Wales.

Subsequently, there is a statutory requirement for UK Doctors to have indemnity and insurance cover. It is stipulated that it is ‘sufficiently adequate’ and of sufficient value to cover claims made in the case of clinical negligence. This can be confusing in certain situations.

The GMC’s website gives clear details of the legal and professional requirement for indemnity.

BMA

It is important to understand what your NHS duties are. Advice from the BMA clearly states all doctors should…

Make sure you have a clear understanding what your contracted NHS duties are and arrange separate clinical negligence indemnity cover for any clinical work you do that is outside the scope of these NHS indemnity schemes or arrangements.

Further reading around NHS indemnity is available from the British Medical Association.

Trainees especially may be required to provide evidence of indemnity cover to their Responsible Officer in the instance of a complaint or adverse event.

Furthermore, where you live will impact on which government schemes underlying NHS indemnity. All the MDO discussed in this article provide uniform cover across England, Scotland, Northern Ireland, Wales, The Isle of Man, and the Channel Islands.

How do you choose the right medical indemnity provider?

So, given the need for adequate indemnity and insurance cover, where do we as physicians start to look for the right scheme or provider. With a choice of competitors to choose from, a little research can help inform the decision for each individual doctors’ needs.

Which medical indemnity and defence unions exist to choose from?

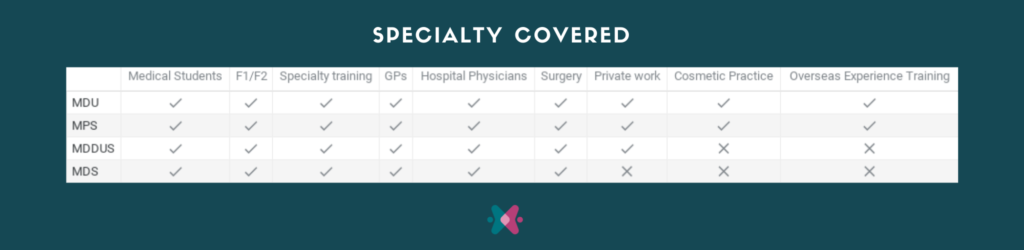

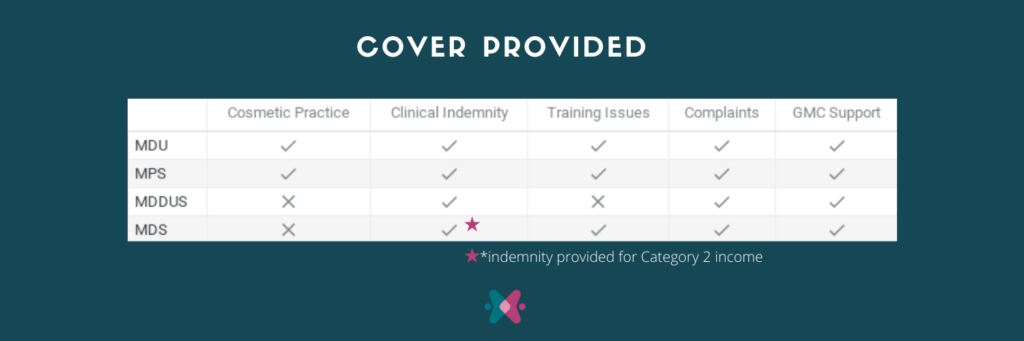

There are several main providers of medical indemnity within the UK. Smaller providers exist, offering clinical insurance but with less support and advisory services. Here we will focus on the main players, and compare the main services provided.

The Medical Defence Union (MDU)

The MDU is a not-for-profit organisation with a comprehensive portfolio of member services, including preparation of media statements, preparation of court reports, preparing inquest reports and statements. They also provide indemnity for Samaritan acts carried out anywhere in the world.

Medical Protection Society (MPS)

Self-reportedly representing over 300,000 members around the world, the MPS is one of the largest providers of medicolegal advice and support but does not provide insurance cover.

Medical and Dental Defence Union of Scotland (MDDUS)

Do not let the name fool you – indemnity can be applied for by any doctor working within the UK. MDDUS was founded in 1902, and has a long history of providing comprehensive indemnity, advice, and support to both doctors. It has been established as a private company but is operated as a mutual membership organisation. This means responsibility falls on the board to protect funds from membership subscriptions to deliver the principle functions offered to its members.

Medical Defence Shield (MDS)

MDS was launched in 2010, as a not-for-profit organisation. It was founded by the British Association of Physicians of Indian Origin (BAPIO) to provide clinical defence and employment services to UK doctors and dentists under a single umbrella. The MDS is the only MDO that provides practical legal representation in employment matters, in contrast to support and advice.

How much does indemnity cost?

The cost of membership is dependent on the details of the clinical practice of each individual application. All the providers were unable to provide Medic Footprints with generic quote. Subsequently it is only by applying to each provider, with individual details that quotes can be given.

Applying for medical indemnity

When trying to choose the right medical indemnity provider, it is worth considering your individual requirements. Providers have some common features to their services, but some may not be appropriate for your needs. For example, an MDO may not provide services for doctors working in private practice. Conversely, another may be dedicated to only provide expertise for general practice.

Assessing your needs

So, a list of your personal circumstances is a good start:

- Simple demographic information is a useful start, including age, date of birth, gender and ethnic background, year, and place of medical qualification. Disabilities can also be asked about.

- What level are you working at (e.g. PRHO, run through trainee, staff grade Consultant, clinical associate/GP etc), and your working pattern (e.g. less than full time, on-call rotas, average hours per week)

- What is your specialty? (Primary care, hospital medicine, hospice care, surgeon etc), and do you have any sub-specialty?

4. Are you employed exclusively by the NHS, or do you undertake private work? If so, what percentage of your time is spent in private work?

5. Do you perform any cosmetic procedures?

6. Medical indemnity providers will ask if you are aware of any ongoing or pending complaints, legal action, criminal proceedings, GMC processes or other actions that involve you. This is to protect them from taking on any doctors who are going to need costly legal support or negligence pay-outs for incidents that happened before they were members. Like applying for car insurance after the event of an accident. They may also ask for a letter of good standing from any previous indemnity organisations to ensure any previous matters have been fully resolved.

7. Do you think that there are any other services that you would like (e.g. mortgage services, financial planning advice, will writing). These services can come at an extra premium relative to more basic packages, so have a think to see if increased monthly premiums will cause you stress or bring you peace in other areas.

Additional services

Alongside medical indemnity, MDO provide a wider range of services such as counselling, education, media guidance and support. The more of these services that an MDO provides, the higher the premium for membership tends to be.

Changing medical indemnity provider

It is possible to change providers, and this may happen depending on your individual needs and requirements at different stages of your career. Sometimes, medical negligence claims and complaints can arise years after an event occurred. All the providers guarantee to represent members who were with them at the time of the incident, even if you have changed provider since. This includes GMC matters.

Conclusion

Medical indemnity is now essential for all doctors working in the UK, to run parallel to the indemnity provided by healthcare providers and government schemes. This can provide peace of mind and services that can be incredibly useful and supportive, especially during challenging periods.

It is important to look at the services provided by each to determine which is the most appropriate for you given the nature of your work, and stage of your career. Approach each for quotes to determine the most appropriate according to financial situation, balanced with your professional needs.

We do hope this has helped you choose the right medical indemnity provider for you.

Check out our Career Guides for the low-down on many alternative career pathways!

Chris Barton

Latest posts by Chris Barton (see all)

- How to choose the right medical indemnity provider for you - 4th November 2020