Understanding finances when setting up a virtual private practice

In association with ClinicYOU, we explore all the financial considerations when setting up a virtual practice practice

There are so many finer details to understand with regards to finances when setting up a virtual private practice. It may be helpful to seek advice from a specialist accountant, especially if you do not have much experience in accounting and tax!

When setting up a new private practice, what you actually have to do will depend on where you work and whether you employ others.

It is worth noting that it may take a few months before you start making any profit, so be prepared to cover all the start up costs without an income initially.

Running a virtual private practice from home

There can be many financial advantages of running a business from home:

- Save on commuting time and costs

- No office / room rent

- Be more productive with your time if patients cancel last minute

- ….to name a few!

Business insurance

If you are running a virtual private practice from home, your usual home insurance may not cover business equipment such as your computer. Business insurance can cover your business equipment and stock against loss, damage or theft, property damage and money that’s lost if something prevents you from working (business interruption). You can compare the types of business insurance providers here.

Tax allowances

You can include business costs as part of your self-assessment tax return if you are a sole trader or part of a business partnership. For example, you can claim a proportion of your phone and broadband bills, heating and lighting costs, and council tax. You can calculate your allowable expenses here. You then add this to each tax return as a simple “use of home as an office” expense.

Understanding finances when setting up a virtual private practice

Tax

Registering with HMRC

You will need to register your new business with HMRC within 3 months of setting up.

Legal structures for your business

It can be difficult when first setting up your business to figure out your business structure. There is no right or wrong answer, it very much depends on the person, their circumstances and how much profit the business is producing. As you would expect there are pros and cons for each choice. The Government’s website has a great summary on what the different structures are and how you go about setting it up/assessing the tax impact.

Sole trader vs Limited company

If you do not incorporate your private practice and work as a sole trader, your total income will be taken into consideration by the HMRC towards tax allowance. There have been some recent issues with doctors being faced with huge tax bills due to the impact of pension taxation rules.

Limited companies currently pay 19% corporation tax on any profits. However the downside is that if you take money out of the company, you will be liable for the usual rate of income tax rate of 20-45%. It can be useful to keep the money in the company to be used more effectively later on. For example, for business operational costs and growth.

Furthermore, by setting up a limited company you can reduce your National Insurance Contributions (NIC) and income tax by drawing a combination of a salary and dividends. By keeping the director’s salary below the NIC lower profits limit, you will not have to pay any income tax or Class 1 NIC on these earnings. Wages are classed as a business expense so you will not pay any corporation tax on the salary too. The rest of your income can be taken as dividends which will be taxed with a dividend tax rate which is less than an income tax rate….

Confused yet??

One of the biggest advantages of forming a limited company is having limited liability protection. This means that if your business were to run into trouble (debt or legal claims), your personal assets would be protected. A limited company is treated as completely separate from the people who own it.

Sole traders run a company at a higher risk as they are personally liable for any debts and liabilities.

Accounting

Do most doctors setting up a virtual private practice need an accountant?

It is best to have an accountant, and one that understands doctors and private practice. Word of mouth recommendations for a good accountant is probably best. Also, the HMRC seem to have more trust in the figures submitted by professional accountants.

Having said that, there is software out there now that is good at working out the figures. Check out Coconut which is an app for sole traders and limited companies, and has an ecosystem of accountants. Quickbooks are quite popular too!

Business bank accounts

All doctors in private practice will need to set up a separate business bank account and develop a form of book keeping that is easy to use and well organised. Best not to choose an old fashioned bank for this! Some larger banks can take several weeks to open an account. On the other hand, it can take just seconds to open a business account with Starling – all you need is your company registration number (from the HMRC once registered). There are also others – Tide and Mettle are worth a look. Ideally you want something without fees and free cash withdrawals and transactions.

How can ClinicYOU software help manage finances when setting up a virtual private practice

In our last installment of our virtual private practice blog series, we introduced you to ClinicYou – a CRM software created by a doctor for doctors. This software gives you everything you need in one place, to make the running of your practice a success, including managing your finances.

So how can ClinicYOU help manage finances when setting up a virtual private practice:

Billing and payments

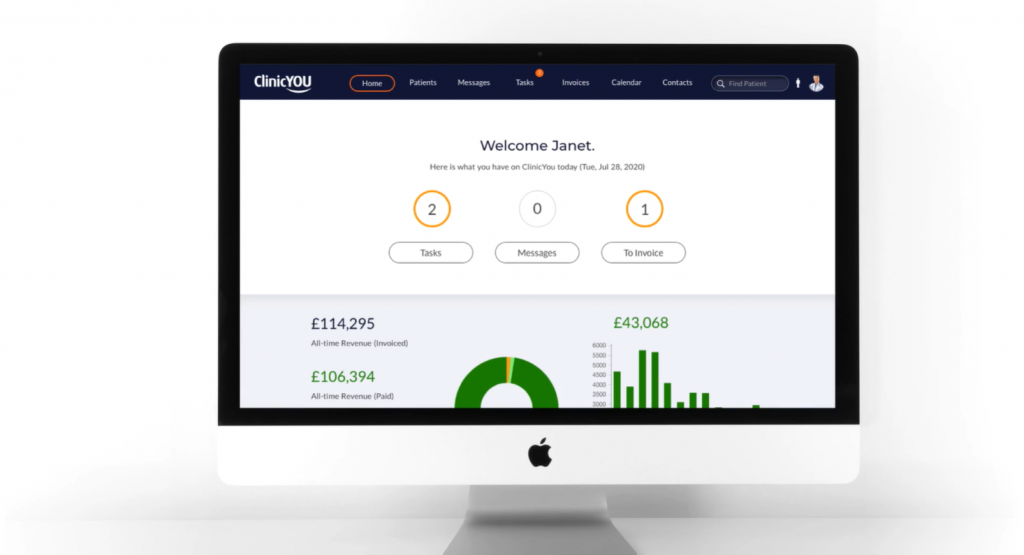

ClinicYou captures all billable activity from appointments and collates them in one place, until they’re gathered up and invoices are created. So you never ‘forget’ to bill. Believe it or not, people do forget to bill! ClinicYou also allows quick, on the fly creation of billable items by clinicians while working, which again wait to be collated.

Invoices will show clinic BACS payment details and clinicians can easily connect their stripe account.

Book keeping

For a start, ClinicYou provides clarity of your earnings at all times. You know how you are doing compared to the previous years, so there aren’t any surprises come year end. It is always good practice to put away money in a tax fund prospectively – the ClinicYou metrics will give you an idea how much.

It also allows you to record invoice status, which is important as HMRC will want all activity, even if not paid fully! You need to claim bad debts – ClinicYou can easily find them for you.

Want to know more about ClinicYOU?

You can access a free trial of the software and find out more directly on the ClinicYOU website.

This article was compiled and written by Medic Footprints and ClinicYOU as part of a commissioned marketing campaign.

Lauren Colquhoun

Latest posts by Lauren Colquhoun (see all)

- The Private Practice Revenue Calculator: planning your move into private practice - 12th April 2021

- Understanding finances when setting up a virtual private practice - 27th February 2021

- Now is the time to set up your virtual private practice! - 18th January 2021