Finances and Living Costs in South Africa

CURRENCY EXCHANGE RATES

Roughly £1 to 18 ZAR

Check out XE.com for today’s exchange rates.

TAXATION

Personal income taxation is co-ordinated through the South African Revenue Service (SARS). They operate a progressive income taxation from 0 to 40% based on your age and annual salary.

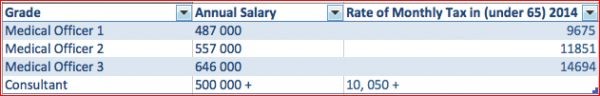

Your personal income tax will be deducted via PAYE if you are working in a public hospital in SA. Below are some indicative tax rates in Rand (R) for the year 2014. For further detailed taxation tables, see the SARS PAYE statutory rates webpage

It is also worth having a good accountant whilst you’re in South Africa, who can guide you through tax returns. We have a list of accountants we work with in South Africa, hence please contact us at info@medicfootprints.org if you require this service.

COST OF LIVING

Working as a doctor in SA will leave you with a high disposable income relative to the cost of living. For most up-to-date prices, please see the Numbeo website.

Conversely however, purchase of cars (new or second-hand) are relatively expensive in rural areas. South Africans tend to run up substantial mileage on cars due to the less developed public transportation (& long distances to cover within SA). Despite high mileage, they remain re-sellable at decent prices and tend to depreciate less if they’re well looked after.

You may find prices are cheaper within the cities, hence worth travelling the distance to get a good deal.

Cars:

e.g. 2009 Kia Picanto – 110 000km for R48 000 (£2600),

2006 Toyota Corolla – 125 000km for R89 9000 (£5000),

2011 Nissan Navara 4×4 – 92000km for R330 000 (£18204).

Start your journey here

Browse hundreds of articles and guides to discover more!